Cracks in the Blockchain: Can Bitcoin Stay Decentralized?

The Fragile Balance Between Freedom and Control

Written by: Andrew B. Raupp / @stemceo

Support ₿: bc1qnu7ek7wd9fsz9xj68wgasw4q56gsep2yhyzsje

Preface: Separating Reality from Speculation

As Bitcoin garners unprecedented attention, we must confront the seductive pull of promised wealth with a critical eye, questioning the intentions and implications of its meteoric rise. The promise of substantial financial gains can be intoxicating, drawing attention away from the deeper questions surrounding its true purpose and long-term implications. As freethinkers, we must challenge ourselves to look beyond the allure of potential wealth and examine the intricate dynamics that define Bitcoin's place in our global financial system. Is it the harbinger of a decentralized future or a cleverly constructed mechanism to divert attention from more tangible assets? This journey requires an open mind and a willingness to scrutinize Bitcoin's strengths, vulnerabilities, and the motivations of those shaping its evolution.

In unity and strength,

-ABR

Citizens Rule Book: A Palladium of Liberty (Download) #InfoWars 🇺🇸

Is Bitcoin a tool designed to divert individuals and governments from accumulating gold? The mysterious identity of Satoshi Nakamoto and cryptocurrency’s historical connections to intelligence agencies and transnational banking interests raise critical questions. These uncertainties cloud Bitcoin’s rapid ascent, leaving its true purpose and long-term trajectory open to interpretation.

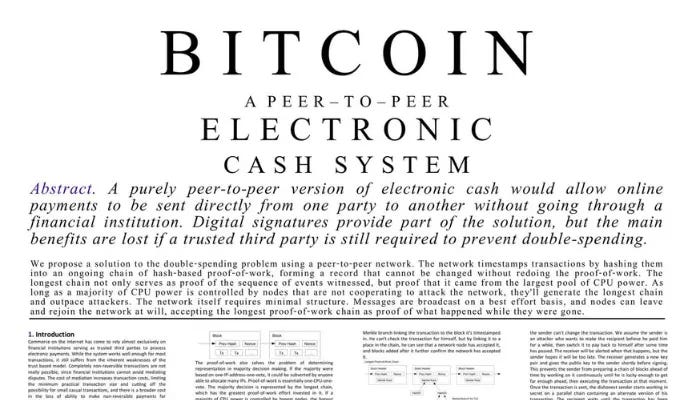

In October 2008, during the global financial crisis, an unknown figure called Satoshi Nakamoto released a nine-page white paper that introduced a revolutionary concept. Bitcoin: A Peer-to-Peer Electronic Cash System outlined a decentralized currency based on cryptographic verification rather than reliance on intermediaries. This innovation sought to establish a universal, censorship-resistant financial system independent of centralized authorities.

The implementation of these principles led to Bitcoin, a digital protocol characterized by transparency, security, and immutability. Over time, Bitcoin’s popularity spread from niche technology communities to global financial markets. However, its evolution sparked ongoing debates about its purpose. Should Bitcoin primarily serve as a medium of exchange for daily transactions, or is its ultimate value in functioning as a store of wealth—a “digital gold”? Could it even be a calculated distraction from more stable assets like physical gold?

The Debate Over Bitcoin’s Role

Bitcoin’s ideological divide reached a critical point in 2017 during the contentious Bitcoin Cash fork. Advocates for Bitcoin Cash argued for larger block sizes to enable faster, cheaper transactions, preserving its use as a currency. Meanwhile, traditionalists focused on maintaining decentralization and security, opting for the original protocol augmented by the scalability of the Lightning Network.

Ultimately, Bitcoin’s dominant narrative shifted toward being a store of value. With a capped supply of 21 million coins, its scarcity appealed to institutional investors and reinforced its comparison to gold. Still, the development of Layer 2 solutions like the Lightning Network reignited hopes of restoring Bitcoin’s utility for everyday transactions. This dual identity continues to shape Bitcoin’s adoption and future.

Challenges to Decentralization

Bitcoin faces a host of challenges that threaten its decentralized foundation. Chief among these is the growing influence of institutional stakeholders. Private equity firms and major asset managers, such as BlackRock, are increasingly acquiring stakes in Bitcoin and mining operations. Through mechanisms like ESG (Environmental, Social, and Governance) mandates, these entities could influence mining practices and erode Bitcoin’s neutrality. Publicly traded mining firms might comply with ESG regulations by embedding restrictive protocols into mining hardware.

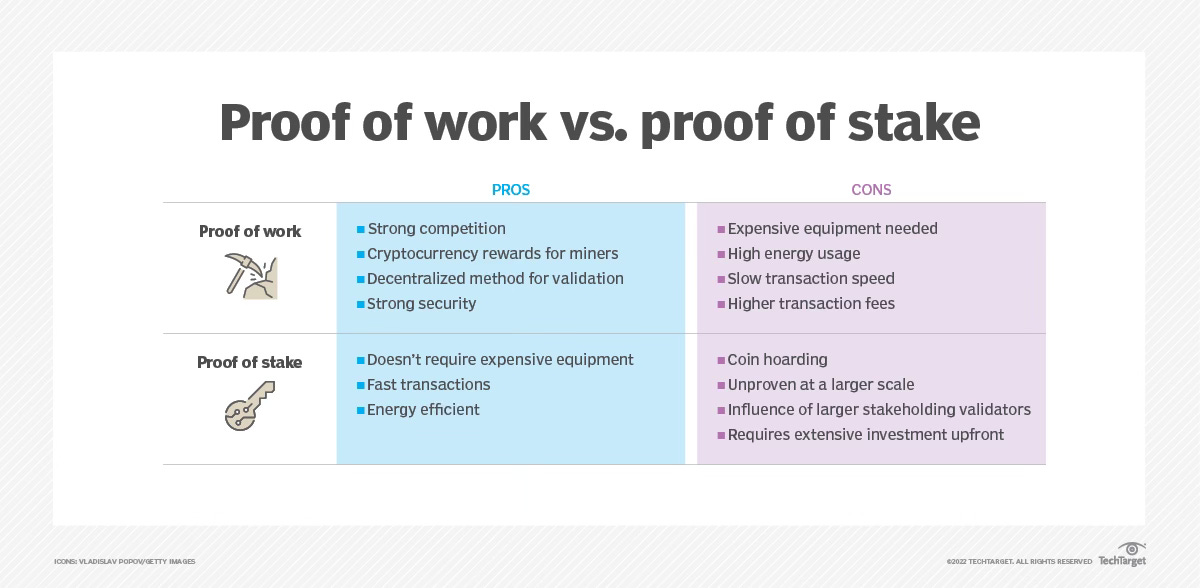

Additionally, the consolidation of mining power and Bitcoin ownership has raised concerns about a potential transition from proof of work (PoW) to proof of stake (PoS). Although PoS offers energy efficiency, it prioritizes wealth concentration over computational effort, undermining the decentralization at Bitcoin’s core. Such a shift would fundamentally alter Bitcoin’s integrity as a decentralized system.

Another significant challenge is the rise of quantum computing. Technologies like Google’s Willow hint at the eventual capability to break Bitcoin’s cryptographic safeguards. While quantum-resistant encryption is under research, implementation remains years away, leaving Bitcoin vulnerable to future quantum threats.

Securing Bitcoin’s Future

To protect Bitcoin’s foundational principles, stakeholders must take proactive steps to address these vulnerabilities. Preventing centralization requires collaboration among miners, developers, and community members. Initiatives such as decentralized mining pools and equitable reward structures can diversify the network’s power distribution and reinforce its resilience.

Quantum resistance should also become a priority. Accelerating research into post-quantum cryptography and fostering collaborations between blockchain developers and academic researchers are critical. By preparing for quantum computing advancements, Bitcoin’s security can remain robust against emerging threats.

A promising solution lies in integrating Bitcoin with gold-backed systems such as Goldback. Pegging Bitcoin transactions to fractionalized gold would provide a dual basis of trust and value. This approach could tie Bitcoin to a historically stable asset while safeguarding it against technological and regulatory risks. If Bitcoin encounters systemic failure, gold-backed alternatives could act as a contingency, preserving financial sovereignty in decentralized formats.

Hybrid systems that combine digital and tangible assets might also attract risk-averse investors. By anchoring Bitcoin to universally accepted assets like gold, the network could achieve greater stability and broaden its appeal without compromising its foundational ethos.

Final Thoughts

Bitcoin remains a groundbreaking technology with the potential to redefine financial systems. Its future, however, depends on the community’s ability to adapt while preserving its decentralized principles. Addressing challenges like centralization, quantum threats, and external influence is essential to ensuring Bitcoin’s longevity. Exploring partnerships with complementary systems like Goldback could help strengthen Bitcoin’s position as a robust, trustworthy asset.

As the world navigates rapid technological and geopolitical changes, Bitcoin’s evolution serves as a lens through which the future of financial autonomy may be examined. Whether it fulfills its promise as a transformative force or becomes a mere distraction from more enduring assets remains a pivotal question—one that will shape the trajectory of economic sovereignty in the 21st century.

Citizens Rule Book: A Palladium of Liberty (Hardcopies) 🇺🇸